The Universal Journal in S/4HANA

Driven by the new data model, S/4HANA paves the way for a fundamental change.

The previously existing separation of Finance and Controlling (FICO) is now a thing of the past.

A common database not only lays the foundation for a close integration of FI and CO, but also for the digitalization of financial processes.

Along with S/4HANA's key concepts such as standardization, simplification, automation and transparency, this defines an intelligent ERP that supports company processes and prepares them for the future with additional features such as real-time reporting or predictive analytics.

From double circuit to single circuit system

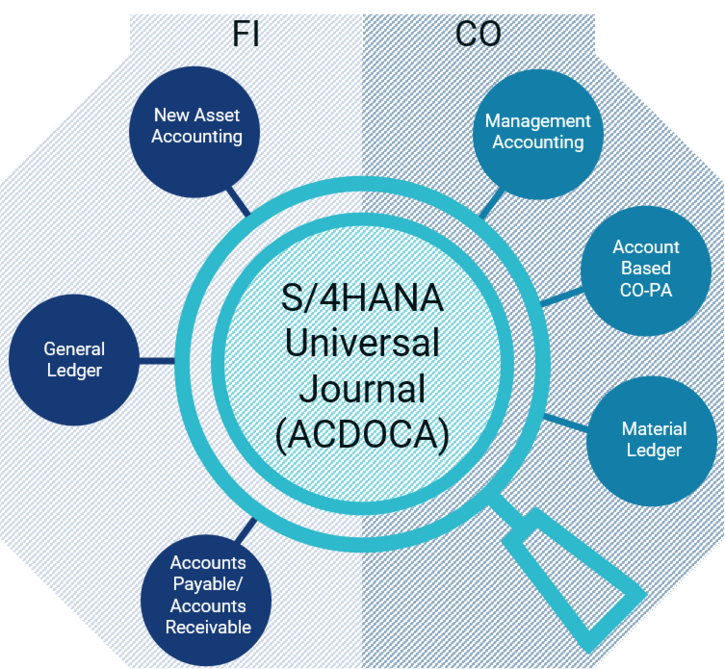

With the introduction of S/4HANA, there are fundamental changes in internal and external financial management. The basis for this is the new data model under S/4H, whereby data from the two modules, which were previously stored in different tables, are now stored together in a central transaction data table - the Universal Journal (table ACDOCA). This creates a central data pool of relevant business data.

This consolidation of data into the single source of truth has an impact on a large number of processes and settings in financial accounting and controlling, as well as on the associated reporting.

The Universal Journal (UJ) forms the basis for the use of the innovative functions under S/4HANA, as well as for real-time and on the fly reporting and multi-dimensional reporting. Together with new applications, such as Group Reporting, it provides an answer to the growing demand for forward-looking and effective reporting tools.

The data streams in external and internal reporting have always overlapped, but in previous SAP versions, meeting the reporting requirements for both areas involved a lot of additional work. The required information had to be extracted from different tables and combined with each other. But the heterogeneous data structures and differences in data granularity in the respective SAP components made this a challenge. Furthermore, reconciliations between sub-ledgers and general ledger as well as extensive rework in SAP BW were necessary.

With the UJ, aggregated tables, index tables and various line item tables became obsolete. It combines transactional data from

financial accounting, actual postings from controlling, asset accounting and the material ledger in a central table, the Universal Journal (ACDOCA).

As a completely new feature in S/4HANA, the UJ responds to known problems in FICO; double data storage, heterogeneous data qualities and complex data processing (with BW extractors) are eliminated.

By storing the data in a common location, a uniform data structure and quality is created. In addition, the flexibility in reporting as well as in analyses increases immensely, which is additionally driven by a shortened runtime due to the increased data throughput.

Functionalities of the Universal Journal

The data model in FICO was completely renewed with S/4HANA. With the introduction of S/4HANA the changeover to the Universal Journal is automatic.

This is accompanied by important changes in Finance & Controlling:

- In the Universal Journal (UJ), financial accounting data is linked with information from Controlling. By integrating CO information in the UJ, a uniform view of all transactions in the FICO area is made possible

- With the complete integration of the accounting profitability analysis in Universal Journal, the contribution margin analysis was optimized in real time

- The new Asset Accounting is integrated in Universal Journal

- The Embedded Material Ledger is integrated in the Universal Journal

- Cost types and G/L accounts are merged

- More flexible and powerful real-time reporting on all account assignments directly in the source system, with increased data granularity

- Aggregation of the data enables real-time evaluations

„on the fly“ - Data quality and confidence in the data is increased

- No differences between finance and controlling. Manual reconciliations and the reconciliation ledger are no longer necessary

- With the predictive accounting function, forecasts of future financial results can be generated based on the existing document flow

- No need for reconciliation between main and subsidiary ledgers or between the various subsidiary ledgers. The general ledger reconciliations have been reduced

- The functionalities of the accounting profitability analysis are greatly enhanced

New and extended functionalities

- Multi-currency capability is harmonized

- The mapping options of parallel valuations were adapted and supplemented

- Real-time data processing enables closing entries to be made in all ledgers

at any time and current booking statuses are evaluated (soft close) - The profitability analysis can be based on market segments in the documents at any

time and in real time without waiting for accounting runs at the end of the period

Advantages of the Universal Journal in S/4HANA

- Harmonization of external and internal reporting

- Data reconciliations between different tables become obsolete

- Data duplicates are eliminated

- Less storage space is required for data storage

- Data throughput is significantly higher

- Greater flexibility in reporting and analysis

The conversion of the data model is the basis for many improvements and innovations in Finance & Controlling. The improvements are listed in the SAP Simplification List.

What needs to be done now

As part of the S/4HANA implementation, you need to ask yourself the following questions in your company:

- What does the conversion to the new data model mean for my finance and controlling department?

- Which innovations can I profit from in my company?

- At which points is a process analysis worthwhile?

- Which processes are affected by these changes?

- Does the conversion also require organizational adjustments?

- Which of the innovative functionalities do I want to implement in my company?

- Which applications do I have to configurate?

- How can I use the new functions for my FICO reporting?

We are happy to support you

Our experts analyze your systems and identify potential improvements in your finance and controlling environment. This includes among other things:

- Identification of weaknesses and processes that require improvement - from a business and IT perspective

- Determination of the strategic and system requirements

- Analysis of the existing system landscape (ERP, legacy systems, BW systems, consolidation, interfaces, integration, homogeneity)

- Analysis of the existing process landscape for uniformity and responsibility

- Analysis of used functions including the determination of implementation options and the conversion effort for S/4 functionalities

- Definition of necessary reengineering activities

We determine your S/4HANA optimization potential by:

- Unification of data models

- Consolidation and standardization of processes

- Use of new reporting functions

- New tools like Fiori

- Use of new functionalities to speed up the month-end closing in FI

- Central business partner maintenance through the new Business Partner functionalities