The term house bank refers to a credit institution through which a company conducts most of its financial transactions. For financial accounting, it is therefore a central object of payment transactions. With the introduction of S/4HANA, this role does not change, of course. What is new, however, is the management of the house bank, which, in addition to the new functionalities, also brings with it some limitations.

In ECC, house bank data maintenance is done in configuration. Via the SAP GUI, one G/L account with sub-accounts per payment type is stored for each bank account, which is then transferred via transport request over the system rail to the productive system.

With S/4HANA, the house bank data now counts as master data. As a result, the data can no longer be maintained directly via the GUI and is now transferred to downstream systems either manually or via an ALE link. With the S/4HANA Finance OP 2020 release, SAP has introduced another option in S/4HANA: Instead of the classic bank reconciliation account solution, the new solution uses a single reconciliation account with various subaccounts per payment type for multiple house bank accounts.

Classic vs. new house bank account logic:

the differences

Advantages of the new solution

The new house bank logic gains significantly in clarity and transparency compared to the classic solution thanks to the reduced number of reconciliation accounts. Handling with the FIORI apps is simplified, and the required configurations and user-specific evaluations are possible with reduced effort.

Account master data maintenance with the new solution

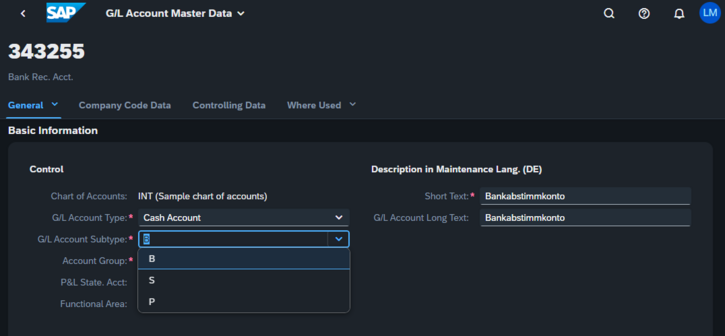

The bank account can be created either classically via the GUI transaction or the FIORI app Manage G/L Account Master Data as a cash account.

The bank reconciliation account is the reconciliation account for the house banks (for example, the house banks in Germany). The clearing accounts must be assigned to this reconciliation account.

The G/L account subtype field is a new addition. Sub-accounts are created per reconciliation account to cover the payment methods. It is also called bank clearing account.

FIORI Apps

With the Fiori apps Manage Banks and Manage Bank Accounts, the master data is created and linked accordingly. Both apps must be maintained with the relevant information.

The Manage Banks app is used to create the house banks with the bank keys and maintain the necessary information. This includes:

- General data

- Company code segment

In the Manage Bank Accounts app, the accounts belonging to the bank are created and the following information, among others, is stored:

- Header data (account description, IBAN, etc.)

- House bank account connectivity

Summary

With the new house bank account solution, SAP provides a simplified solution for the management of bank accounts, which can be optionally used from Release 2020 under the conditions shown. The solution gives the user flexibility in reporting and can reduce both master data maintenance and the associated communication efforts. In addition, it is possible to return to the classic solution even after the migration has been completed, thus creating a secure fallback scenario.