With the mandatory introduction of the SAP Business Partner, SAP has also redeveloped the concept of credit management. The reason for this is as follows: In ECC, the maintenance of credit management was anchored in an independent ECC transaction FD32, which accessed the master data of the customer. The new business partner concept and the associated elimination of the classic customer (transaction XD03) meant that credit management also had to be rethought. In this context, SAP developed the business partner role "Credit Management", with which the master data relevant for credit management can be maintained in the business partner.

The business partner role is not limited to maintaining credit management master data. It also offers all functions that are important for the administration, maintenance, and monitoring of credit management. For example, SAP has integrated the assignment of rights for documented credit decisions and credit monitoring, as well as credit risk assessment, into the role. This allows the customer to be comprehensively monitored in the business partner role: Key figures on payment behavior, credit limit utilization as a percentage or KPIs on payment behavior are available for this purpose, for example. The following functions are mapped or available in the business partner role:

Master data integration

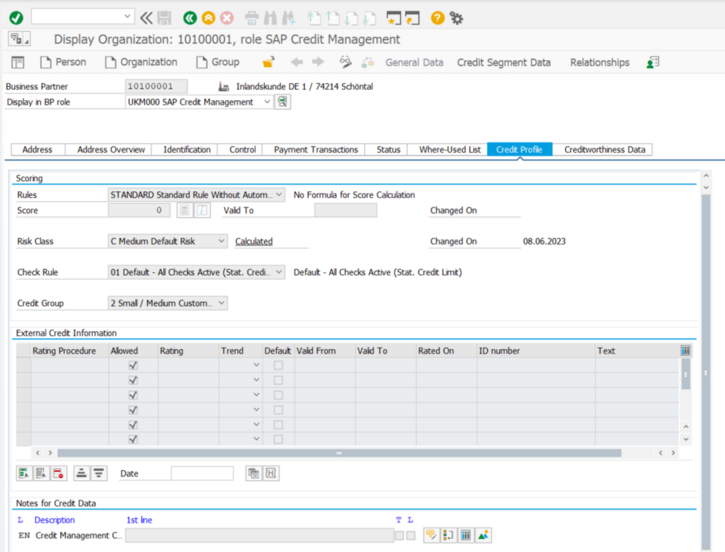

Extensive master data on customers, suppliers and other business partners is created and managed in SAP Business Partner. Within the framework of credit management, this master data is used or accessed to record and store information about the creditworthiness and payment behavior of the business partners. The SAP Credit Management role is activated for the existing business partner in the SAP system. Only the maintenance of credit management-specific master data is necessary, such as the credit limit or the credit segment; general master data such as the address or contact data is taken from the role Business Partner General.

Credit limit monitoring

In the business partner, credit limits can be defined for individual customers or business partners. Here it is possible to provide the credit limit with a validity period. In Advanced Credit Management, the credit limit can be calculated automatically using the credit rule engine and a formula. The credit management monitors these credit limits and automatically blocks orders or deliveries if the credit limit is exceeded. In addition, the credit limit utilization is displayed as a percentage and the total value of the outstanding commitment for the business partner.

Credit Monitoring

SAP Credit Management enables continuous monitoring of payment behavior in the business partner. The functional areas "KPI Payment Behavior" or "Payment Behavior Key Figures" provide various function and overviews to analyze the existing behavior of the business partner and monitor information about payment delays, open invoices, dunning letters and other relevant data that are important for the assessment of the credit risk. Specifically, credit limit utilization, open invoices or dunning level can be monitored, for example.

Credit availability check

When creating sales orders or contracts, SAP Credit Management checks the availability of credit for the customer. It checks whether the credit limit is sufficient to carry out the transaction and whether there are other open orders or receivables. The data for this is maintained in the SAP Business Partner. After the credit limit has been checked, it can be increased, for example, so that the order can be completed.

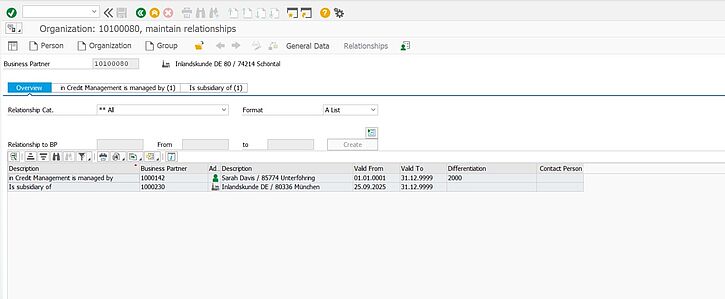

Allocation of blocked documents

In addition, the credit management support is maintained in the master data of the business partner. In S/4HANA, this is mapped via the relationships or different relationship categories. Customers are assigned to employees who are maintained as business partners via the relationship category "is supported in credit management by". The stored employee is thus assigned the blocked sales documents and deliveries in the documented credit decision and can release them there.

Summary

The close integration between SAP Business Partner and SAP Credit Management enables companies to effectively control credit allocation and risk management by bundling the relevant information and functions in a central location in the SAP system (in the Business Partner role). This enables a holistic view of customers and business partners as well as efficient management of loans and credit limits.