Resource Related Billing

The solution for internal accounting

In many companies, internal costs such as IT costs or office rents of a central unit are charged to other units of the company. Often, these companies are not in the same sales tax group or are legally independent entities. In these cases, for tax reasons, an internal settlement must be made with a tax-compliant invoice. If the amounts are the same each month, this process can be carried out in SD using billing plans, but if the amounts are different and based on expenses, manual billing is often used here, which involves a lot of work for the sales and finance department.

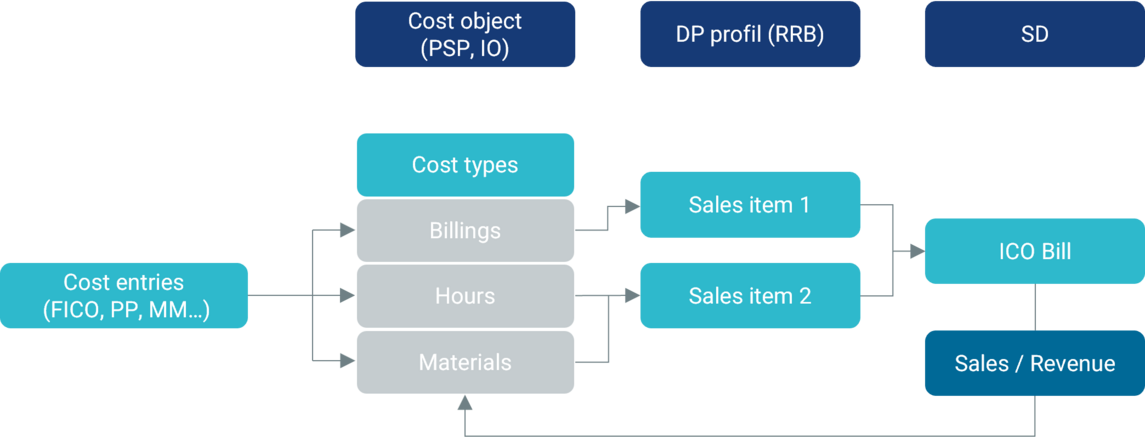

For these cases, SAP offers a possibility via Resource Related Billing (RRB) to automatically allocate costs of a period incurred on cost objects such as WBS elements or internal orders. In this process, costs incurred on cost elements are reallocated to articles and the costs are cumulated, which appear as items on the invoice. It is not necessary to allocate 100% of the costs incurred, a restriction can be made here via the cost elements. The revenue from the ICO invoice can be posted back to the cost object and settled to the profitability analysis as intercompany revenue. Via the intercompany process, these invoices can also be posted directly to the receiving unit via EDI.

Internal billing processes can be significantly simplified and automated with RRB without leaving the SAP standard. We are happy to support you in the introduction of an efficient and effective solution for internal billing.

Functions of RRB

- Determination of costs on a cost object by cost element

- Reallocation to items/articles according to cost elements

- Generation of an intercompany outgoing invoice with tax processing

- Automation of the process in the background without manual intervention

- Posting of intercompany sales to the cost object and settlement to profitability analysis